First Licensed Tokenized S&P 500 Index Fund Hits the Market

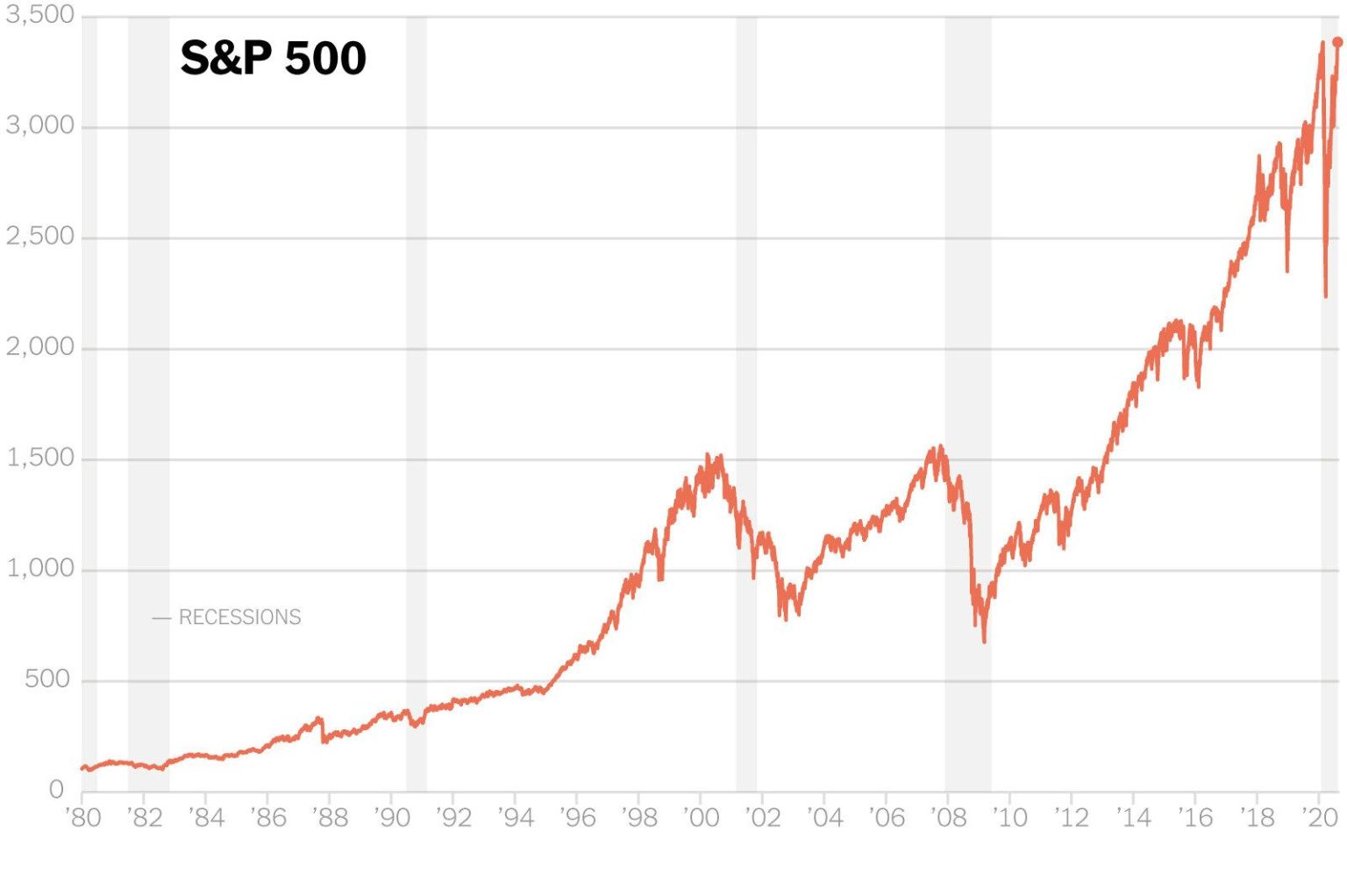

Tokenization is making waves on Wall Street. On September 25, Centrifuge, Janus Henderson, and S&P DJI introduced SPXA, the first licensed S&P 500 index fund.

SPXA tracks the S&P 500, offering exposure to this crucial index in the world of decentralized finance (DeFi). It’s designed for DAOs and on-chain funds, providing clarity and programmability. This move marks a important step for real-world assets in crypto.

According to Bhaji Illuminati, CEO of Centrifuge, “the S&P 500 is a cornerstone of global finance. SPXA makes it accessible on-chain, 24/7, for investors worldwide.”

Janus Henderson, with $457 billion in assets under management, will manage the fund. Nick Cherney, Head of Innovation at Janus Henderson, said, “SPXA brings the S&P 500 to a new generation of investors, expanding secure access to global markets.”

S&P DJI’s involvement adds legitimacy. Cameron Drinkwater, Chief Product Officer at S&P DJI, noted, “our collaboration with Centrifuge supports liquidity and transparency in the blockchain ecosystem.”

Key points:

- SPXA is the first licensed S&P 500 index fund in crypto.

- It offers exposure to the S&P 500 for DeFi platforms and DAOs.

- Janus Henderson manages the fund, ensuring professional oversight.

- S&P DJI’s involvement adds institutional credibility.