Jupiter Token Surges as Decentralized Lending Platform Launch Approaches

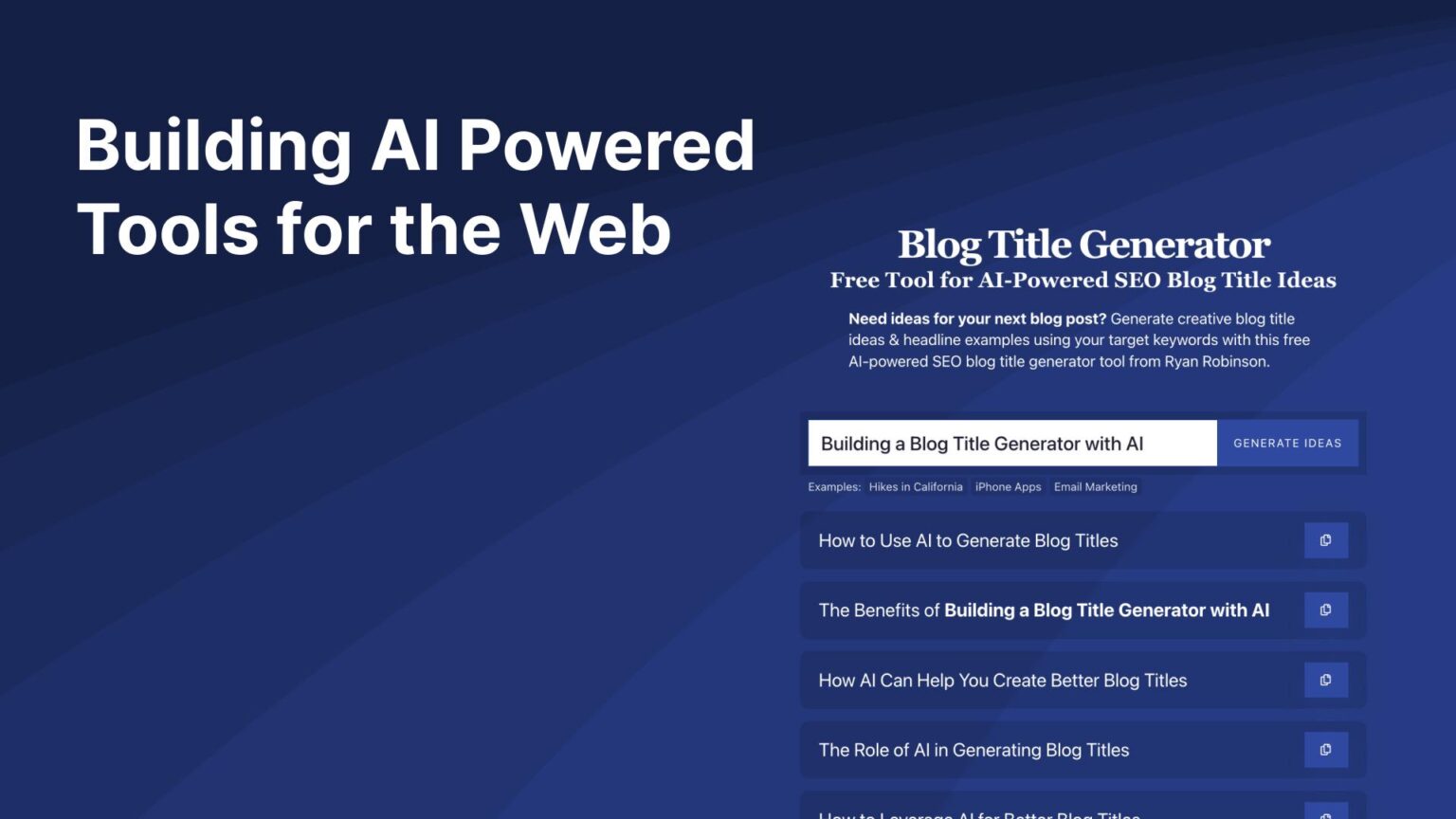

The Jupiter token (JUP) has soared to its highest levels in months, thanks to the anticipated launch of its decentralized lending platform. On May 26, JUP saw a 15% increase, trading at $0.61. This price jump takes it back to its March levels, driven by the protocol’s expansion plans.

The main reason for JUP’s rise is the upcoming release of Jupiter Lend. Announced on May 22, this lending platform is scheduled for a summer 2025 launch. It aims to be Solana’s most advanced money market. Jupiter Lend will offer a loan-to-value ratio of up to 90%, higher than the 75% typical in crypto lending. Platform fees will also be as low as 0.1%.

Jupiter, Solana’s biggest dApp, benefits from the network’s growth.By July, 42% of solana’s DEX transactions will pass through Jupiter. The platform holds 95% of the DEX aggregator market share. Solana’s increasing DeFi metrics have also boosted Jupiter. The value of Solana memecoins hit $14 billion, up from $6 million in July.Network activity has risen too, wiht 7.3% more weekly transactions, totaling 462.5 million. solana now processes more weekly transactions than other chains combined.

Solana also leads in active addresses, reaching over 34.7 million, compared to Base’s 9.2 million. Discover more about Solana’s growth.